Many CEOs think the chief financial officer (CFO) is a utility position… and they’re dead wrong. It’s easy to see the CFO as a glorified “scorekeeper” reporting arrears on things like revenue, expenses, profit/losses, and cash flow/burn. But this work is actually a very small part of a CFO’s larger value: A good CFO doesn’t just keep the “score” — he or she puts points on the board. If hired and managed properly, they can become a superstar on the executive team.

Like the CEO, CFOs have a company-wide view on the business. They operate in the middle of all the data flows in and around the business. A good CFO uses this vantage point to make a good company great, leading a high quality finance organization that manages critical responsibilities for the company. They do this by informing important strategic and operational decisions; finding new insights to improve business performance; and ideally being a consigliere to the CEO. (The CFO is also the public face of a company to its investment community along with the CEO during and after an IPO.)

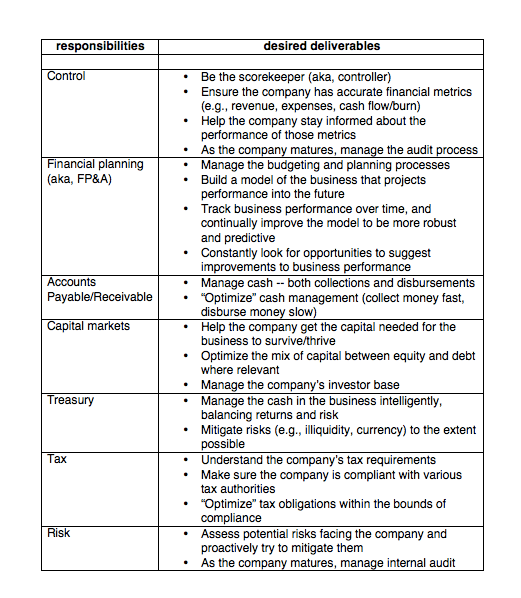

On first glance, each of the above responsibilities and deliverables have a “bean-counter” look to them, but if you pause and think about each one in terms of how it helps you build a better business, you’ll see the value a CFO brings. Take FP&A for example: It isn’t just budgeting, but rather is about helping you understand exactly how your business works and where the levers are. And adroit management of accounts receivables/payables can have the side effect of lowering the capital the business needs to raise, in turn lowering dilution. And so on…

But when do startups need to build these functions and hire a CFO?

Here are a few key questions that early-stage organizations grapple with when figuring this out, along with my thoughts…

When should we hire the ‘take the company public,’ experienced CFO?

A company should be well on its way to maturity before looking for a high-powered, experienced CFO. In the early stages, you need finance professionals that are willing to roll up their sleeves and get their hands really dirty, tackling unsexy tasks like mapping out and building out the core financial plumbing of the business or managing audits. Highly experienced CFOs haven’t done activities like these in years, because they’ve had the luxury of relying on large teams and mature systems. Few have a desire to dive back into this hands-on work.

What should we look for?

And: what’s most important in sequencing the finance function? First, you need someone who can adeptly handle the control function — this is the only way to know the score and assess how the business is going. But financial planning is also critical as it enhances the company’s understanding of its business and helps to improve it. So I recommend starting with one top person who can manage both of these roles well. Then, you can add in dedicated people for the other roles (capital markets, treasury, tax, risk) as the business becomes more complex, and as the company grows to a sufficient size where the leverage from doing these functions well will cover the cost of the incremental headcount.

Can we wait to add the CFO?

And who would manage the finance organization as it scales if you do wait? When your finance organization starts getting populated enough that it’s challenging to manage, it’s useful to add an interim finance leader under the titles of either “VP of Finance” or “Director of Finance”. An ideal hire for this job would be a high-potential finance professional who has the raw talent to become a CFO, but hasn’t yet had enough experience to step immediately into that role.

Why can’t I just outsource this function?

This is a very dangerous idea. Outsourcing essentially reduces the finance function to low-level accounting — it will never advance the business. Therefore, not having this role in house robs CEOs of the opportunity to discover critical knowledge that will radically improve their company: trends, opportunities, possible threats to the business. These insights, when acted on, can make the difference between building a middling vs. standout business.

How do we go about hiring a CFO then?

My partner Jeff Stump, who manages our executive talent network and operation, advocates that CEOs meet other executives currently succeeding at this role in other companies. Won’t that delay our own hiring, you ask? No, because you’ll hire better if you develop an understanding and appreciation of what “world-class” in that role looks like. Also, CEOs who lack a robust personal network should explore hiring a recruiter (note, this depends more on the individual partner than the firm itself) who specializes in searches for that class of executive. Make sure you are working with the right individual, someone with expertise in the domain who ideally has done recent searches for the exact position you’re seeking.

* * *

A good finance executive almost always pays for themselves immediately, whether it’s through a better fundraise, optimized spending and cash flow, or more revenue due to key insights. We constantly hear from CEOs who finally hire a great CFO that they wish they had done it sooner. When a CEO hires the right person and empowers them to do their job well, great things ensue — profitability improves, fundraising gets easier, financial processes gets tighter, resource allocation gets more strategic, forecasting improves… the business, simply put, gets much better and stronger, sooner.