In 2021, Chris Dixon wrote about how creators can use NFTs to monetize their “1,000 true fans.” Since then, NFT use-cases have multiplied. Case in point: The rise of NFT memberships, which require fans to hold a specific NFT to join a private community and enjoy its perks. NFT memberships give creators a way to strengthen their brands, build communities that have value, and let fans share in the upside as the community grows.

From working on creator growth at Twitch and Facebook, as well as writing about the creator economy, I believe that NFT memberships will become a creator monetization channel that rivals ads and subscriptions. Drawing on real-world examples, I’ve broken down why creators might consider NFT memberships, how they’re used in practice, and how creator economy and web3 startups can capitalize on their growing popularity.

The case for NFT memberships

While all NFTs are digital collectibles stored on the blockchain, different types can fulfill different purposes. People often buy profile pic NFTs (PFPs), for instance, to use as avatars. With NFT memberships, however, an NFT is a ticket to an exclusive group. Think: Soho House or a country club, but membership is online-first and entry hinges on being a token-holder vs. having the right connections.

More and more creators are wading into web3 by building NFT communities for their fans. For business-minded creators, NFT memberships can replace and complement traditional subscription and ad-based revenue models in several ways:

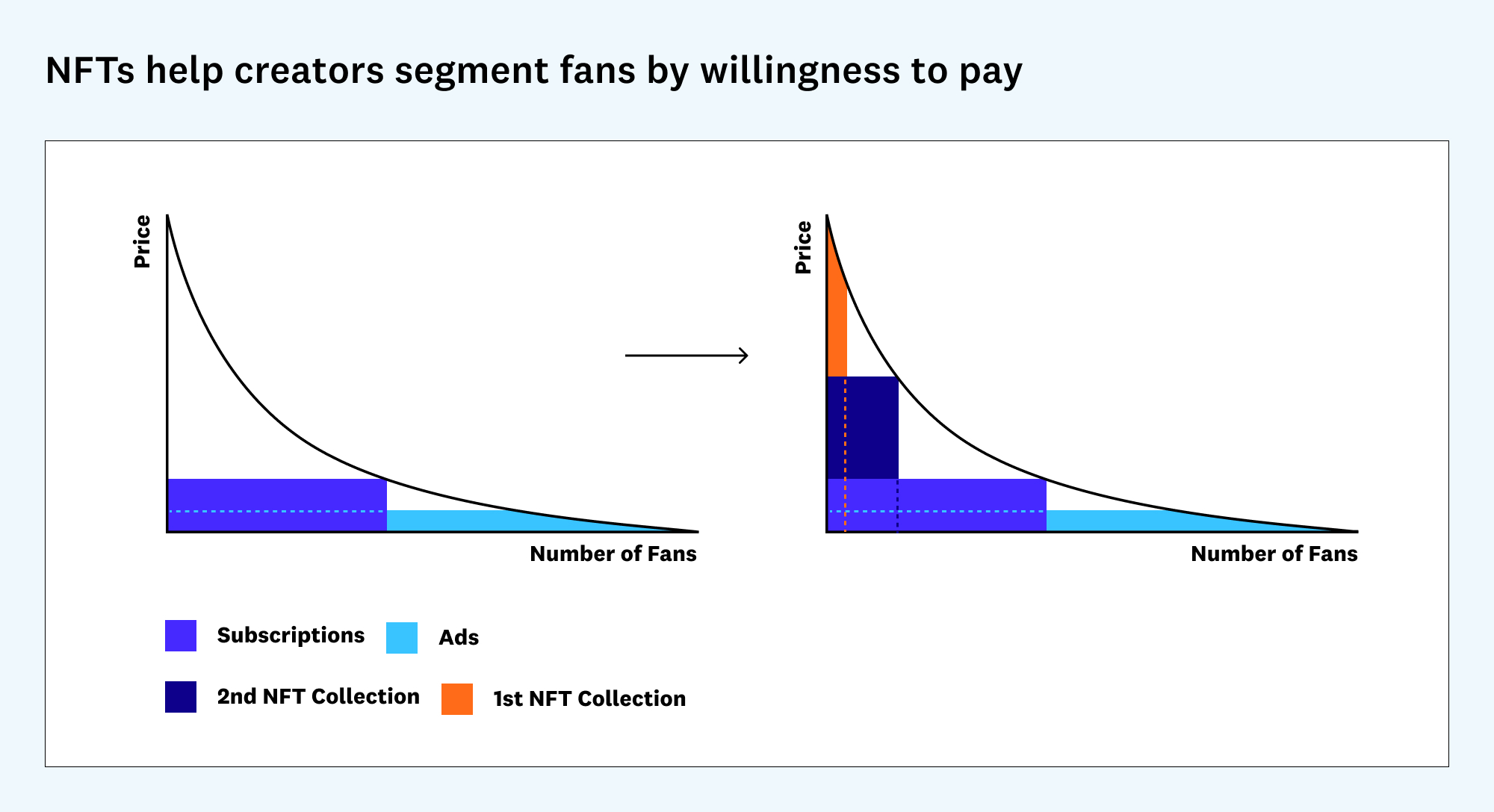

Creators can earn more from NFTs by segmenting fan willingness to pay. On traditional platforms like YouTube, creators use ads to target casual fans who won’t pay for content and subscriptions to target fans who are willing to pay a small amount. As a result, they’re leaving money on the table from true fans who will pay much more. NFTs let creators earn more by targeting fans at all levels. A creator could launch a limited edition NFT collection to target their biggest fans and launch subsequent collections to target more casual followers.

Creators can earn more from NFTs by reducing middleman fees. Traditional platforms take a large cut of creator earnings from both subscriptions and ads, and they can change policies at any time without creators’ permission. With NFTs, creators keep most of the revenue they earn from the initial mint (see this NFT mint guide) and then also make additional revenue from royalties.

Creators can meaningfully acknowledge early fandom. On traditional platforms, a creator’s early supporters don’t reap any rewards as the creator becomes more popular. Sure, someone can say they discovered a YouTuber before they got famous — but that’s hard to prove and it’s unlikely that early-fan status will confer tangible benefits. NFTs, on the other hand, give fans a way to definitively demonstrate early fandom of creators they believe in. Creators can reward those early fans with benefits, such as access to events and special releases. In addition, early collectibles of creators (from musicians to athletes) often appreciate based on the success of the creator. In that way, NFTs directly motivate fans to help creators succeed.

Challenges of NFT memberships

There are also potentially difficult aspects of NFT memberships for creators to be aware of.

Creators don’t have direct control over the price of NFTs after mint. Although creators can set the initial NFT mint price and their share of secondary royalties, they have less control over NFT prices going forward. If, for example, the overall NFT market crashes, creators could end up earning less from NFTs than traditional channels. Alternatively, speculators could buy a creator’s NFTs and pump the price without giving real fans a chance to participate. To preempt the latter problem, creators could promote NFT “allow list” spots to fans early on, before speculators learn about the project. They could also set rules to prohibit any single person from buying too many NFTs at once.

Creators might alienate fans if the value of the NFT isn’t clear. Creators need to clearly articulate the value of their NFT membership to avoid disappointing fans. Fans hold creators to their word and expect them to deliver long-term utility for the NFT membership. Launching an NFT membership without clear plans for how to provide value to members puts a creator’s reputation at risk.

Managing an NFT membership community is a lot of work. Community management is a significant commitment on top of a creator’s existing content-production schedule. To help lighten their workload, a creator could hire a team to keep the community engaged and encourage fans to play a role in bolstering the value of membership. But it’s unlikely that they’ll be able to fully outsource engagement duties — a creator is, after all, the heart of their brand.

How creators use NFT memberships in practice

What are the minimum requirements to get an NFT membership off the ground? Successful communities generally have three components:

- The creator already has an engaged fan base to invite to buy their NFTs.

- Fans buy NFTs to join the community and help add to the value of membership.

- The creator and their community provide utility for the membership in the form of real-world benefits.

Let’s look at three examples of NFT membership communities that illustrate this model well.

VeeFriends, an NFT collection from Gary Vaynerchuk, who, among other things, co-founded both the reservations platform Resy and the digital agency VaynerMedia, of which he’s CEO.

- Creator: Drawing on his entrepreneurial credibility, Gary built a huge, multi-platform audience.

- Community: Gary onboarded his audience to the VeeFriends community through education on why NFTs matter and how to buy them for the first time. He drew and invented backstories for all the characters in his NFT collection, imbuing tokens with a personal connection.

- Utility: All VeeFriends holders get a free three-year pass to the conference VeeCon. The inaugural VeeCon, which took place in May 2022, featured heavyweight speakers like Snoop Dogg and Beeple. VeeFriends holders played a critical role in organizing the event.

Moonbirds, the second NFT collection from Proof Collective, a private community from Kevin Rose.

- Creator: Kevin hosts the popular crypto podcast Modern Finance.

- Community: Proof’s first NFT collection had 1,000 passes. Many top NFT collectors who listen to Kevin’s podcast bought these passes, which seeded the community with talent and created latent demand for Moonbirds.

- Utility: Moonbirds holders are incentivized to hold onto their NFTs long-term to unlock exclusive rewards such as merch and real-life events.

Developer DAO, a DAO launched by developer Nader Dabit after he left AWS to focus on web3.

- Creator: Nader Dabit built an audience on his YouTube channel, which focuses on developer education. He then launched Developer DAO to accelerate the education and impact of web3 builders.

- Community: Developers and other talent purchased the Developer DAO NFT, amplifying the appeal of membership.

- Utility: Access to the community itself has become the primary perk of the NFT. Members have helped each other host events, build projects, and land jobs.

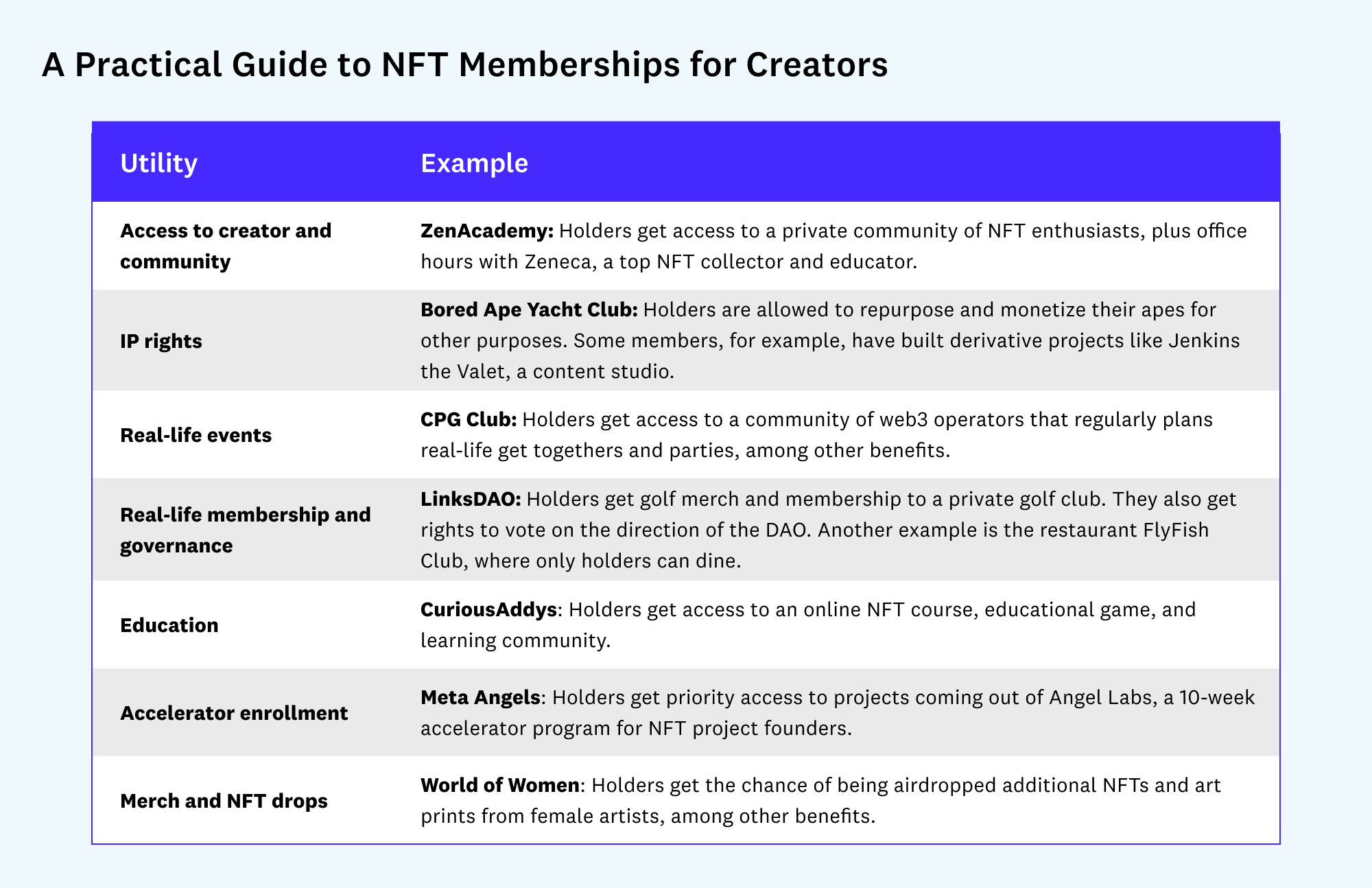

Here are other examples that illustrate how NFT membership projects can provide long-term utility:

How companies can help creators manage NFT memberships

Creators and communities are experimenting with NFT memberships in new ways. As this trend picks up steam, creators making the jump from web2 to web3 will need help throughout the user journey. To support creators, startups can:

Create the NFT membership

- Define the membership details (e.g., goal, audience, quantity, price, benefits).

- Recruit a team or select a no-code solution to make the art, smart contract, and website.

Introduce the membership to fans

- Build a community and teach fans why the NFT membership is valuable.

- Use allow lists to reserve NFTs for fans vs. speculators.

Work with the community to create value for the NFT membership

- Understand which holders contribute the most to the community.

- Work with holders to provide ongoing utility for the NFT membership.

Managing the business

- Manage and find ways to fund the treasury, such as through partnerships.

- Manage taxes and legal contracts.

Many companies are already tackling the challenges above. I’m excited to see more creators and communities use NFTs as a tool to create value and share in the upside.

Views expressed in “posts” (including articles, podcasts, videos, and social media) are those of the individuals quoted therein and are not necessarily the views of AH Capital Management, L.L.C. (“a16z”) or its respective affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.