A decade ago, equity compensation — paying employees with company stock — was a perk reserved solely for executives. The practice was largely deployed by companies as a way to optimize retention while keeping their balance sheets clean. Since then, equity compensation has expanded quickly. Within the next 10 years, it’s estimated that public companies will compensate employees with nearly $800 billion in Restricted Stock Units (RSUs), stock promised to employees upon meeting certain conditions. Given the 400+ IPOs last year, the growth of equity compensation in tech shows no sign of slowing. Tech companies alone are projected to pay employees over $40 billion in RSUs this year, according to Candor’s salary database.

This massive proliferation of stock compensation has decisively shifted job incentives, particularly in the tech industry. It’s not an exaggeration to say that in 2021, the most important factor determining a person’s wealth is which company they choose to work for. But wealth managers are not yet equipped to help workers decide between taking a job at, say, Snapchat or Stripe. As equity compensation has evolved from a C-suite perk to a common payment feature in the tech industry, many employees are left fending for themselves.

Glossary of key terms:

Derivative: A securitized contract whose value depends on an underlying asset.

Hedging: A way to manage risk of loss by attempting to predict market movements and making purchases to offset them.

Forward contract: A contract for the sale of a security based on a projected price in the future.

Grantor Retained Annuity Trust (GRAT): A financial instrument used to move asset appreciation from the grantor to their beneficiaries, reducing one’s tax burden.

Options: A compensation contract in which companies grant a number of price-locked shares that employees can buy at a discount, using their own funds.

Restricted Stock Unit (RSU): A form of employee compensation in which receiving shares is subject to a vesting schedule.

Trust: A legal vehicle set up to hold assets separate from yourself, managed by someone else.

Today, the financial infrastructure for employees paid in equity is nearly nonexistent. For those with little experience in the acronym-riddled realm of equity, the ins and outs of stock as compensation and its tax implications can be dauntingly complex.

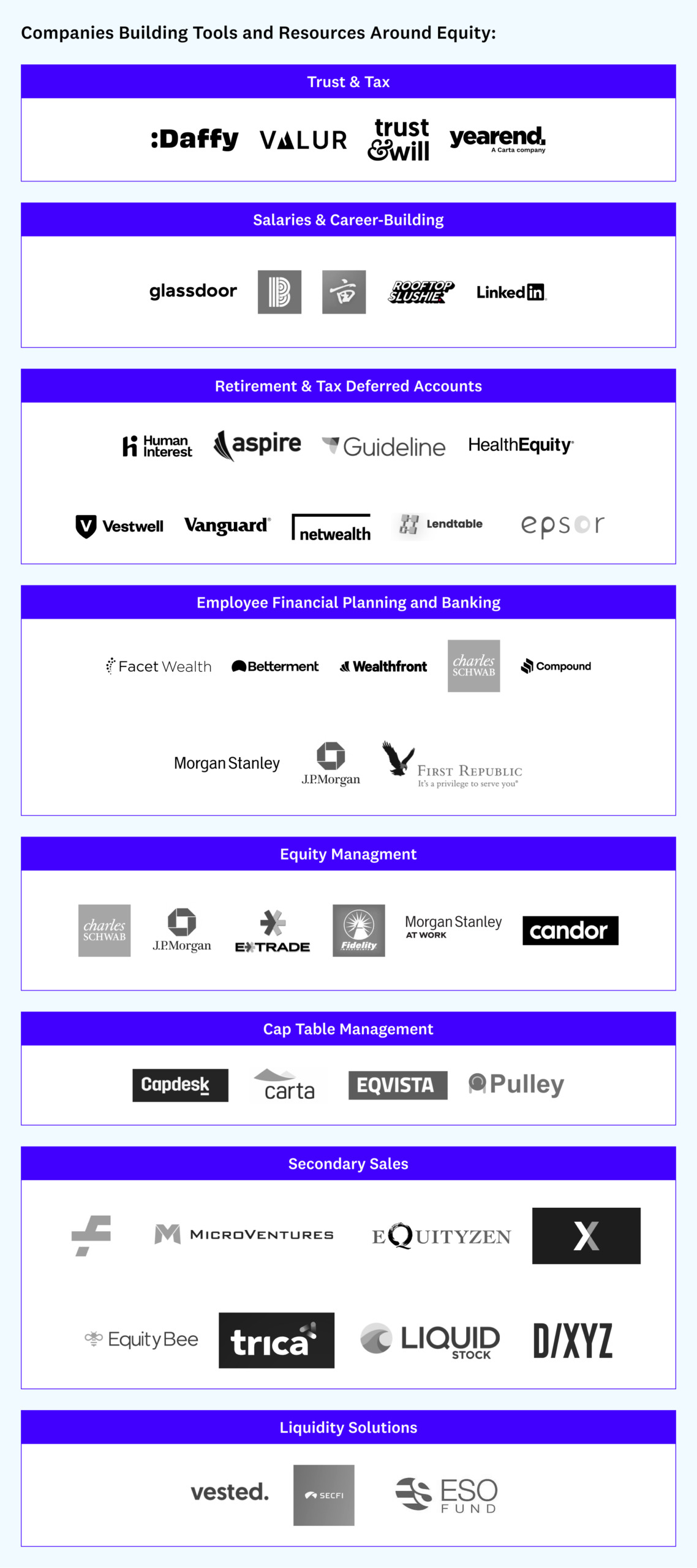

For tech companies, there’s an opportunity to better bridge the knowledge gap by expanding access to equity data and offering resources for tax management. For builders, there’s a dearth of tools that help those paid in equity manage risk and wealth responsibly.

Below, I address the main challenges for employees paid in stock, as well as strategies for countering them; how forward-thinking companies can change the equity landscape; and where I see promise for tools that better serve both.

But first, a quick history of how we got here.

The equity shift: From executive perk to salary expectation

The tools currently used for understanding and managing equity compensation were largely built in the ’70s. In 1972, the Financial Accounting Standards Board issued Accounting Principles Board Opinion Number 25 (APB 25), which allowed companies to avoid recording stock options as a compensation expense on their income statements.

After that, stock options gained wide appeal as a form of compensation. By the mid-1990s, Standard and Poor’s Execucomp database showed that 85 percent of executives were receiving stock incentives in one form or another. That didn’t last long — amid mounting allegations of tax evasion, fraud, and scandals at Enron and Worldcom, many companies abandoned stock options in favor of the simpler accounting structure of restricted stock units, or RSUs. Whereas with stock options, employees are given the opportunity to lock in a price to buy stock later, RSUs are units of stock given to an employee that the employee doesn’t have to buy.

The widespread adoption of RSUs meant that, for the first time ever, employees would get access to a perk previously only available to senior leaders. By democratizing the returns of company creation, this trend also meant that more smart, capable people were drawn to work in tech, where innovation and early belief are duly rewarded. By 2007, even one of Google’s in-house massage therapists became a millionaire from stock she received as an employee. Things evolved fast.

However, the ecosystem of tools and frameworks to help newcomers understand their equity did not develop at the same pace. The expedited adoption of stock options, and later RSUs, as compensation contributed to some of the complexities we see today around equity.

For employees: Constraints around equity compensation and strategies for making the most of it

Employees often face four common challenges in understanding and managing equity: trading restrictions, concentrated risk, data asymmetry, and tax complexity. I’ll unpack each below, as well as strategies for mitigating downside and risk when navigating them.

1. Trading restrictions

Though insider trading laws in their basic form date back to 1909, regulation as we know it today was largely set in the mid-’80s, catalyzed by increased political lobbying and by the SEC and Congress taking a harder line on insider trading. Today, many of the laws that govern stock compensation today remain unchanged from their original purpose: preventing insider trading by executives.

In reality, it’s hard to define who has access to information that can create a trading advantage. So companies made a calculated decision: every employee, no matter how junior, is legally treated as an “insider.” This means employees can only sell stock when allowed, even if they own it outright. At many companies, this window comes around quarterly after earnings calls, when the stock is often most volatile.

That stipulation can leave those who are compensated in stock in the dark; many tech employees have limited understanding of the options available to them to access liquidity. According to a 2021 Candor research report, of the 30 largest public tech companies, only 11 have developed policies to help employees set a stock disposal schedule. This makes it difficult for those paid in stock to use equity for pressing life needs, for instance, without significant risk around market and concentration exposure.

In fact, there are several mechanisms available to employees that can help free up liquidity.

- Staged sales: The mechanics of staged sales are simple: You designate how and when you’d like to sell stock ahead of time, then a third party executes your instructions. As a result, employees can freely sell stock — even during blackout periods, mergers, and litigation — and use staged sale proceeds to address immediate cash needs, like buying a home, or invest them into more risk-balanced portfolios. In a Stanford study, staged stock selling plans showed 6 percent better returns over time, as well as cohort benefits like tax optimization and reductions in market risk and concentrated positions.

- Lines of credit: Employees can collateralize their RSUs to get a loan. This is usually used for temporary liquidity, when the person doesn’t want to sell their stock. This can be a good option to “have your cake and eat it too” if the stock grows at a faster rate than the loan interest. (However, on the flip side, if the stock declines, you may face a situation in which selling stock is necessary to meet your loan obligation.)

- Block or large-chunk trades: These trades involve the sale of a large number of securities, pre-negotiated with the company, at a discount from the stock’s last market price. Generally, block trades are used when disposing of the stock might affect the market price or outside perception. These are most often used by employees with a high concentration of RSUs who need to dispose of a large amount of stock to rebalance their portfolio. This strategy may be a viable option for very early senior employees past IPO.

2. Concentrated risk

A second challenge many employees encounter around equity compensation is concentrated risk. A tech employee may have as much as 90 percent of their wealth holdings in their company’s stock via their compensation, according to a Candor market survey of over 1,000 tech workers. Since workers are limited as to when and how they can sell, liquidity, company, and market risk can compound against them over time.

Thanks to stories about massive payouts making early employees at FAANG companies overnight millionaires, many millennials and Gen Zers have been conditioned to treat their stock like a lottery ticket. They’re taught that holding onto it will make them rich. Sometimes, that’s true.

However, often it isn’t. In the early days of Covid in March 2020, for example, Uber employees lost over 50 percent of their stock value over a period of a few days (the stock has since rebounded). Other companies experienced similar declines; no company is immune to a market upset. A March 2021 JP Morgan Chase study of 13,000 large-cap, mid-cap, and small-cap stocks from 1980 to 2014 showed a decline of 70 percent or more in the price of a stock from its peak, after which there was little recovery. The study suggests that declines are not related to singular events, like the tech boom-bust — or a pandemic, for that matter.

To a stockholder with a concentrated position, even a small loss matters. In general, most investment advisors don’t recommend having more than 10 percent in one stock. While employees may be tempted to hold a concentrated stock position in the hope of a big payday, past returns are not a guarantee of future profits.

Here, too, there are diversification options for employees, including automated hedging strategies — ways to automate risk management — and derivatives, financial contracts dependent on the underlying RSU/stock value.

Derivatives are risky and harder to execute on your own, but they can offer more flexibility for selling or holding positions, income generation, volatility management, and risk reduction.

Primer: How derivatives work when you have RSUs

- Protective puts: Think of this as buying insurance against stock decline. You can continue to participate in the stock appreciation, while setting a price floor. On the flip side, however, this can eat into appreciation, especially when inflation is high.

- Covered calls: Being paid to sell your stock. You set the conditions for sale — when and at what price — assuming a price that’s higher than the current market. A buyer purchases the option to buy at that price and you receive an upfront premium. If the exit conditions you set are met, the buyer can choose to exercise and buy your shares. If they’re not met, you still keep the premium. It’s worth noting that here, again, you take on some risk: If the stock rises more than your estimate, you may miss out on gains. You can also lose money if the stock price falls below the break-even point — the purchase price of the stock minus the option premium you received.

- Zero-premium collars: This is a tool to manage volatility and is often used around IPOs. In this case, you spend nothing. A bank or broker takes all the downside risk by buying an option for a premium and selling a call option at the same time on your behalf. These options “zero out” because you buy and sell derivatives of equal value. If the stock falls below a certain level, the bank pays you the difference, but if it rises above a designated mark, the bank keeps the appreciation.

Not all tech companies allow employees to purchase derivatives. In addition, few mechanisms exist today to oversee and manage compliance around derivatives. As the Securities and Exchange Commission and the Department of Labor continue to scrutinize equity pay and insider trading, I expect the creation and introduction of compliance tooling will become a hotly contested space.

3. Data asymmetry

A third hurdle employees confront around equity compensation is that many companies rely on data asymmetry to retain talent. Unfortunately, compensation architecture can often be a cat-and-mouse game in which companies layer on complexity to avoid exceeding total payout caps, while employees band together in forums to reverse-engineer total compensation numbers. It can be nearly impossible for a job candidate to easily compare offers involving equity compensation from multiple companies without outside help.

All this intricacy surrounding equity means many tech employees rely on outside sources to gather valuable information. That includes professional networking forums like Blind, Elpha, and 1Point3Acres to vet companies, investor databases like Morningstar and Crunchbase to gauge company performance and metrics, and online forums such as Candor, Triplebyte, Angelist, and Option Impact to crunch salary data. A thriving secondary market has sprung up around people selling their meticulously compiled equity spreadsheets and methodology to other tech employees. This knowledge gap is ripe for new software tools and innovation.

4. Tax complexity

Finally, tax planning is often neglected when it comes to equity compensation. Most companies treat RSUs as supplemental income, which means withholding much less tax. The flat IRS rate for supplemental wage income of up to $1 million was 22 percent in 2021; in contrast, the federal income tax rate for a tech employee filing single earning $209,426 to $523,600 was 35 percent. This gap can result in tech employees owing substantial amounts to the IRS after a vest.

Though there are many tax instruments that can benefit tech employees, finding an accountant who can structure a tax plan around equity compensation can be difficult. In a 2021 Candor survey of 1,500 employees at public tech companies, for instance, only 47 percent reported having a tax plan.

Companies today offer little support in helping employees understand and plan for taxes. This leaves an opening for the democratization of a wide range of mechanisms and resources, including:

- Deduction planning products: Deduction bunching is the practice of timing tax write-offs on things like mortgage interest and health savings accounts to offset RSU taxes. In the near future, I believe deduction-planning products that help employees optimize paycheck deductions, plan capital gains through stage sales, and calculate 83(b) election and deduction bunching will become table stakes for companies.

- Structuring as a service: I call this the “other” SaaS. While it is possible to do some tax maneuvering on your own, strategies like variable prepaid forward contracts require institutional support. Think of these as a tax optimization strategy with simple mechanics: you sell a block of stock directly to a brokerage without finalizing the transaction. The brokerage gives you around 75 percent of the cash you’re due now and the remaining 25 percent later. Because the transaction is not “done” until you get all your cash proceeds, you can technically defer capital gains tax until the full contract is fulfilled. As wealth managers and companies alike look for ways to offer employees liquidity that doesn’t result in a tax avalanche, this is an example of an area where I believe we’ll see a lot of near-term growth.

- Qualified small business stock exclusions: Another opportunity exists around QSBS exclusions for founders. Currently, anyone who starts or invests in a startup can exclude up to $10 million from tax after sale “per taxpayer.” However, planning around this, such as sequencing the liquidation of low- vs. high-basis stock, is unnecessarily complex. With an accelerating number of exits on the market, I believe this strategy will move from obscurity to a staple of equity management, furthered by companies. (As of Nov. 19, 2021, the House of Representatives has passed new limits on QSBS exclusions, which reinforces the need for planning ahead of a qualifying event.)

For companies: Optimizing a new financial stack around equity pay

It’s time to revise our thinking on what it means to be paid in equity. Every employee, not just executives, deserves tools and resources to make informed decisions and trades, manage risk, and navigate taxes around equity. This realization means that more companies are exploring equity management as an employee benefit.

We’ve already seen firms like Fidelity, Morgan Stanley, and First Republic market “financial wellness” as a perk to tech companies. However, the offerings to date — better lending rates, staple investment tools, ATMs on campus, student loan help — have often been shallow.

As a subset, tech employees have certain unique qualities: they’re a group of accredited investors holding concentrated positions, often with a higher appetite for risk than previous generations. In the future, companies will increasingly use access to management tools as a mechanism for employee retention. In addition, I expect banks will modernize their offerings to be more akin to health insurance providers, updating their billing models to build custom deals and products for each tech company. Within the next five years, for example, we will likely see consolidation in the alternative investment space as firms compete to deliver value to this new generation of consumers.

To date, we’ve seen the most activity in taxes and trusts through startups that build tools to streamline the tax-planning process, and platforms that help plan for charitable giving.

A trust is a legal vehicle set up to hold assets separate from yourself and have them managed by someone else. For tech employees, trusts can often be used more effectively than retirement accounts, and are easier to set up than hedging and derivatives. In most cases, trusts don’t have contribution limits, carry many of the same benefits as retirement accounts like IRAs (such as tax deferment), and can offer upfront liquidity before retirement. There are several types of trusts tech employees should be aware of:

- Donor Advised Funds (DAFs): Think of this as a mechanism to front-load deductions to manage capital gains while donating to charity. The employee transfers a lump amount of RSUs into a DAF and can claim the full amount, up to 30 percent of their adjusted gross income, as a tax deduction for the same year.

- Charitable Remainder Trusts (CRTs): A split interest situation: you get some, you donate some. In a CRT, the stock appreciates inside the trust, free of capital gains. The trust then pays you or your beneficiaries income until you die. The remainder of the trust value goes to charity.

- Zeroed-out Grantor Retained Annuity Trusts (GRATS): A mechanism for transferring the appreciation of your assets to a beneficiary.

- Intentionally Defective Grantor Trust: Makes your stock into a bond through structuring.

Offering a comprehensive investment management suite will soon become a competitive advantage for companies. For big, public companies, this may include everything from basic upgrades, like the tax tools and staged sale strategies described above, to more drastic changes, like giving employees the ability to deposit pay into trusts to optimize tax benefits.

Today, many of the above techniques might feel obscure to anyone without a menagerie of lawyers, accountants, and wealth managers, but such strategies can be immediately useful to anyone earning RSUs. Within the next few years, I believe we will see the creation of sophisticated tooling to layer these products holistically, in consideration of employees’ full financial situation, risk appetite, and goals.

For builders: New career platforms will disrupt compensation

As an extension of this innovation, I believe a new class of job-picking tools will emerge combining wealth management, career progression, and taxes. Glassdoor 2.0 will feel more like a PitchBook and less like a job board. Employees will be able to run projections and simulations that neatly tie considerations across their whole financial stack.

As it becomes easier for employees to price and compare equity between offers, companies’ ability to obscure the value of total compensation will erode. This will lead to a new class of enterprise products focused on helping employees capitalize on their equity.

For startups, I hope to see the tokenization of equity (such as Restricted Token Units, or RTUs), stock buy-back programs from investors, the repackaging of equity into lower-risk instruments that let employees diversify earlier than the existing secondary market opportunities, and pre-negotiated access to lending instruments with banks.

We’re already seeing regulatory discussions surrounding RTUs; the main hurdles today are compliance-based. In particular, there’s lack of clarity around whether crypto pay should be treated as a security or property for accounting purposes, and how that will affect employers. There’s a significant market opportunity for a third-party provider to handle back-office accounting, compliance, and escrow for companies who want to offer RTUs at scale.

The future of equity compensation

In the tech industry, equity compensation has completely changed the incentives around choosing a job. For a certain set of job seekers, knowledge work has become a vehicle for building a portfolio of equities.

Within the next decade, equity compensation is likely to go even more mainstream, moving beyond the tech sector. Even within old-school industries like durable goods manufacturing and finance, the use of RSU pay is rising. In 2019, 92 percent of all industries surveyed by the National Association of Stock Plan Professionals had an equity-based incentive plan in place.

Equity compensation offers the prospect of meaningful wealth to employees. However, tech workers should think of it as an investment, not a lottery ticket. For employees, this means considering risk, diversification, and taxes proactively. In turn, companies need to realize that the narrative of treating equity as a pledge of loyalty can ultimately harm the same employees they aim to reward. Instead, there is an opportunity to become a catalyst for employee wealth by building a vetted ecosystem of services and tools, similar to how we tackle health benefits today. The future is an infrastructure that engenders financial inclusion and responsibility over speculation.

Views expressed in “posts” (including articles, podcasts, videos, and social media) are those of the individuals quoted therein and are not necessarily the views of AH Capital Management, L.L.C. (“a16z”) or its respective affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.