We’ve outlined some core principles of social token design, but it’s equally important to complement such designs with product-market fit that intrinsically motivates users. For example, a play-to-earn game that focuses its efforts on enabling users to profit but that doesn’t get the “play” element right misses the point: that games are, first and foremost, supposed to be played for fun.

A product that’s bootstrapped around a reputation system but lacks true product-market fit risks creating a community of speculators, rather than of actual users.

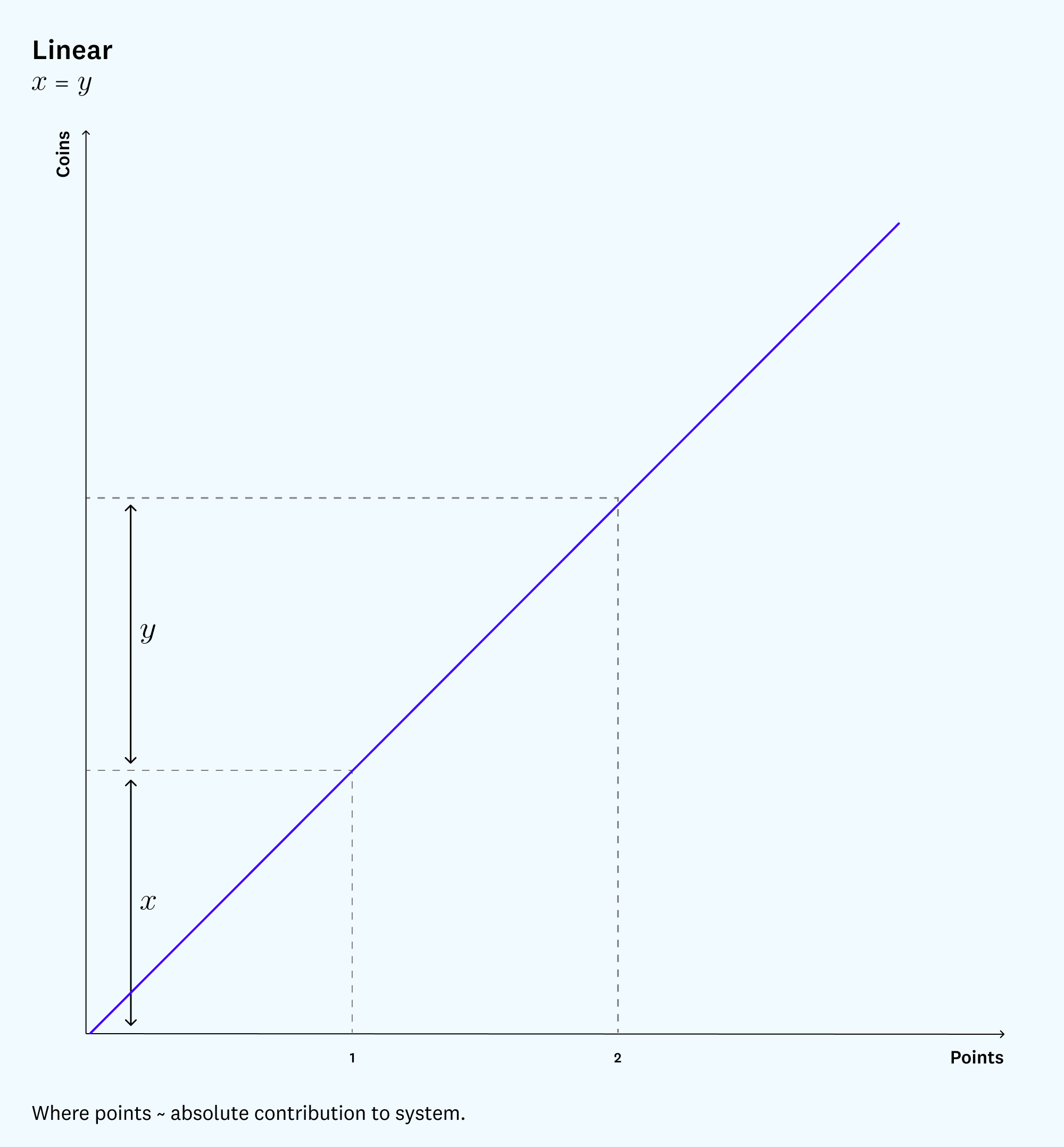

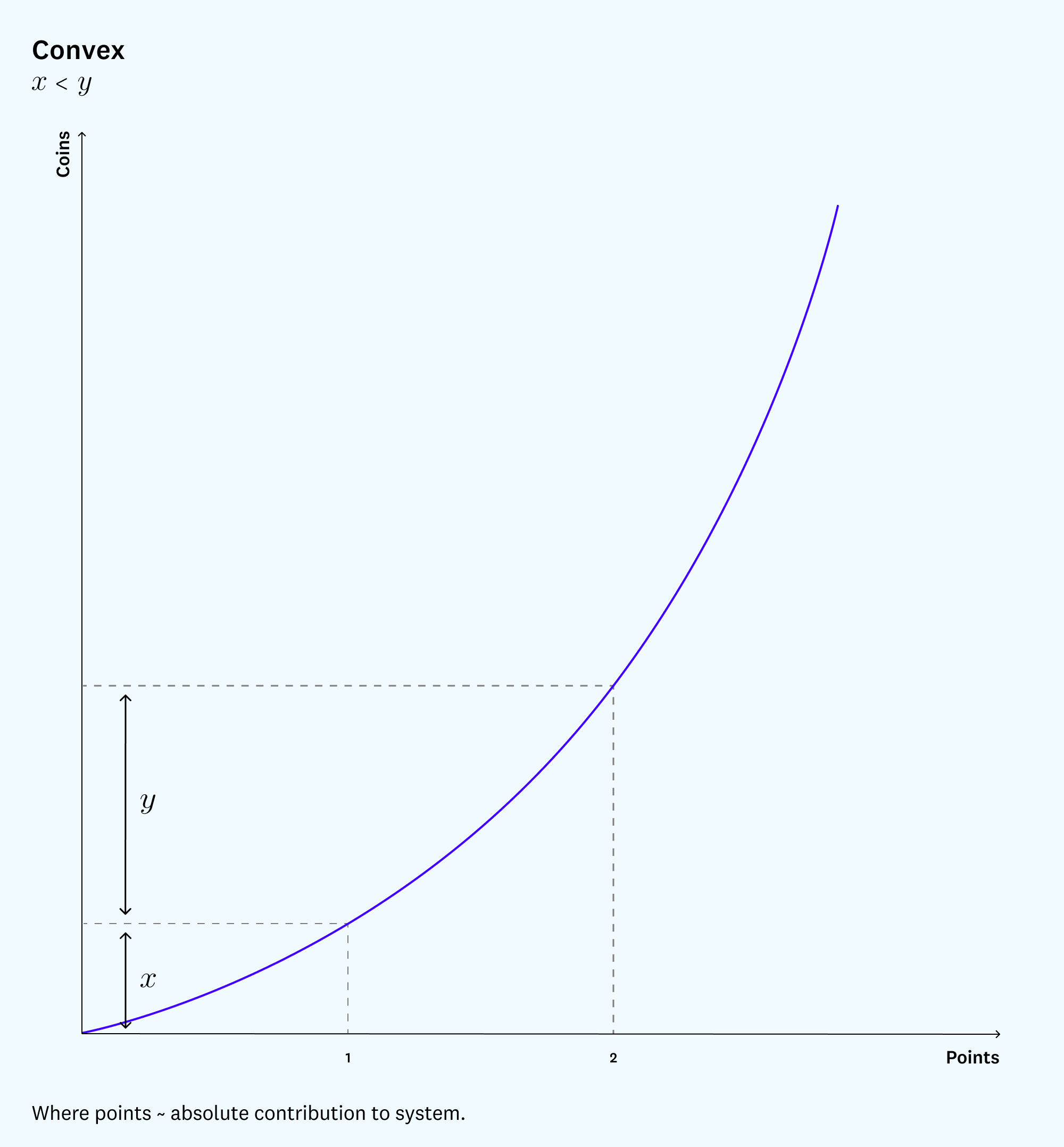

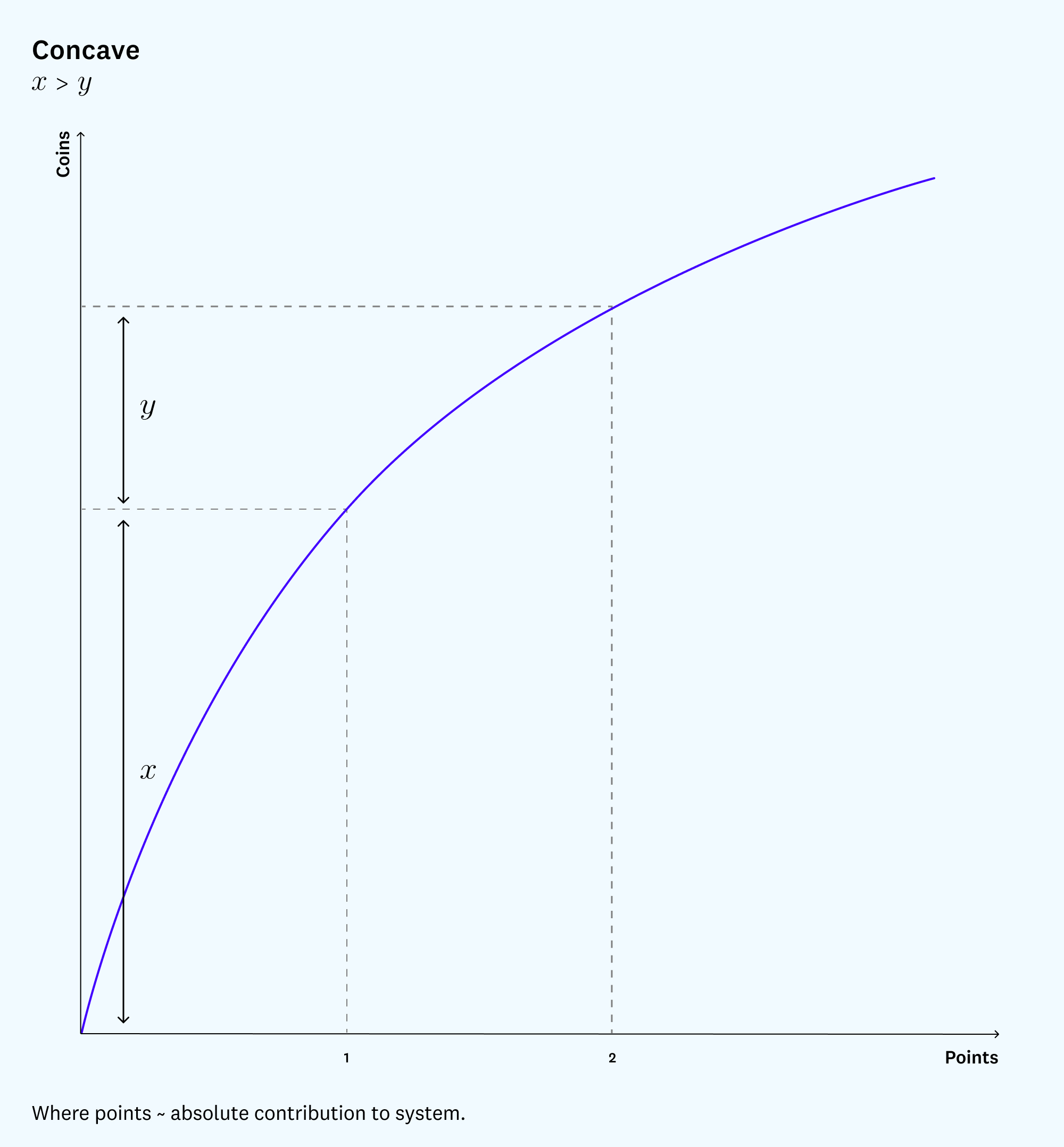

But once product-market fit is achieved, incentive dynamics take over. It would be very difficult for a platform to scale and reach mass adoption if it doesn’t reward users properly. To make the incentives work, a reputation system should separate social capital from financial capital, particularly if the former offers a clear path to the latter.

* * *

There’s much more to consider here, such as the relationship between governance and reputation; making the reputation system responsive to the evolution of the contributor community; and making reputation building accessible for all types of contributors. But we believe that if builders embrace the two-token system design at a high level, they’ll be able to reward contributors with an authentic reputation signal that holds its value even while generating liquidity. That’s precisely what these projects need to drive growth.

Acknowledgments: This essay is a response to a community request via GhostKnowledge. Thanks to Sari Azout, Christian Catalini, Far, Jihad from Forefront DAO, and David Phelps for their input.

Disclosures: Jad Esber is an investor in a number of NFT and DAO projects. Scott Kominers provides market design advice to a number of marketplace businesses and crypto projects, including Novi Financial, Inc., the Diem Association, and Quora.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.